In two thousand thirty-six, humans will be on the moon. We will build homes using big robots. They take moon sand and make strong buildings. People will live there for a long time.

The robots work by themselves. They get orders from smart computers. They make round domes. The domes protect from the sun and bad stuff from space. People can breathe and eat inside. We will use moon stuff so we don’t hurt the Earth.

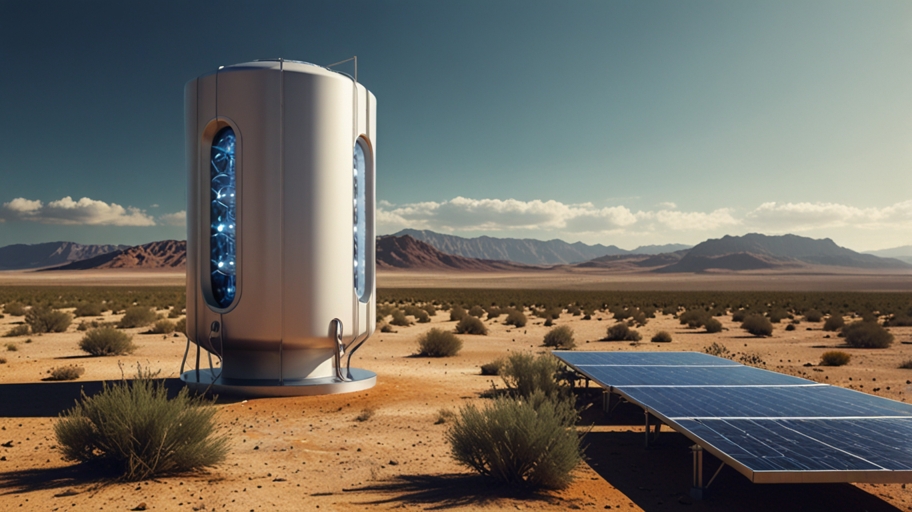

The robots get energy from the sun. The solar panels store energy for nights and bad weather. This makes building cheap and easy. The same way also works on Earth for green buildings.

People from around the world work together on this. They share ideas to build better robots. This moon success will help us get to Mars too. By working together, we can solve problems for our future.

There are hard things on the moon. The robots get better with tiny tech to be safe. Living on the moon gives people hope. Many will want to explore space together as a team.

From the moon to the Earth, lunar looms lead the way in eco-friendly structures. This fresh approach sets the stage for robust urban expansion. Cities follow suit by adopting green technologies. Hence, this epoch heralds a bedrock era for humanity’s daring and united cosmic fate.

Leave a Reply