Gas prices in the Philippines are going up again this week. Retailers revealed yet another price hike this week, which is the second in a row. Gasoline will rise by P1.35 per liter. Diesel and kerosene will climb by P0.80 and P0.70 per liter, respectively.

This price hike will start from Tuesday. This will affect individual motorists as well as commercial transport operators. This is due to global developments, including the US sanctions on Iranian oil and a reduction in the US crude inventory, which has affected the international oil supply.

The Department of Energy already predicted these price hikes. The new petrol prices have nearly topped the price rollbacks during the holy week. Since the start of 2023, both petrol and diesel prices have gone up by over P3 per liter.

Pump prices for fuel in Metro Manila are still high. Premium gasoline is close to P68 per liter; diesel is above P50 per liter. The latest price increases have not yet been added to the current prices. Soon, this will push fuel prices to record highs for 2023.

Transport groups are worried about the rising operating costs. Logistics and delivery services are also trying to cope with squeezed profit margins. For many small businesses, fuel costs are hurting profits, especially as consumers are spending less.

High fuel prices raise the costs of goods and services, including public transport and food. Worries about inflation are ahead. Analysts are watching oil for more price changes if the supply is disrupted. OPEC will affect future prices.

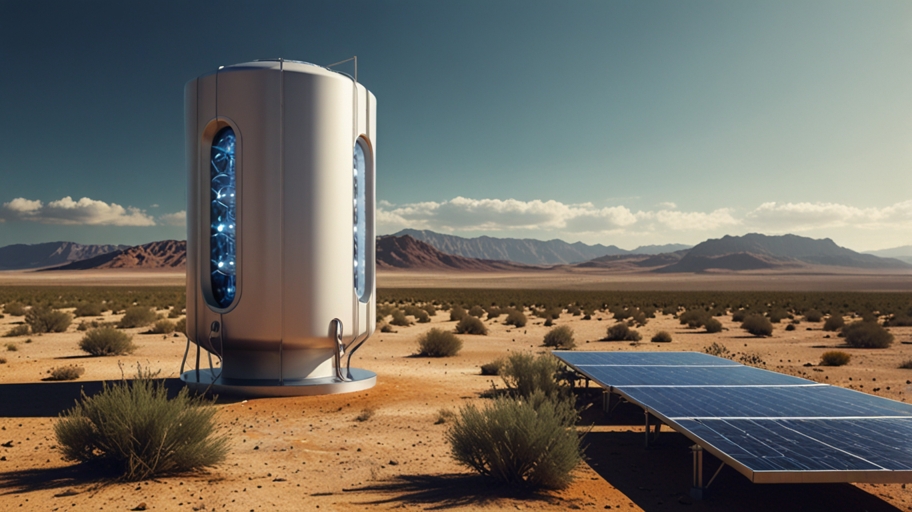

The Philippines needs energy-saving and alternative options due to rising fuel costs. The weeks ahead are important for households and businesses.

Leave a Reply